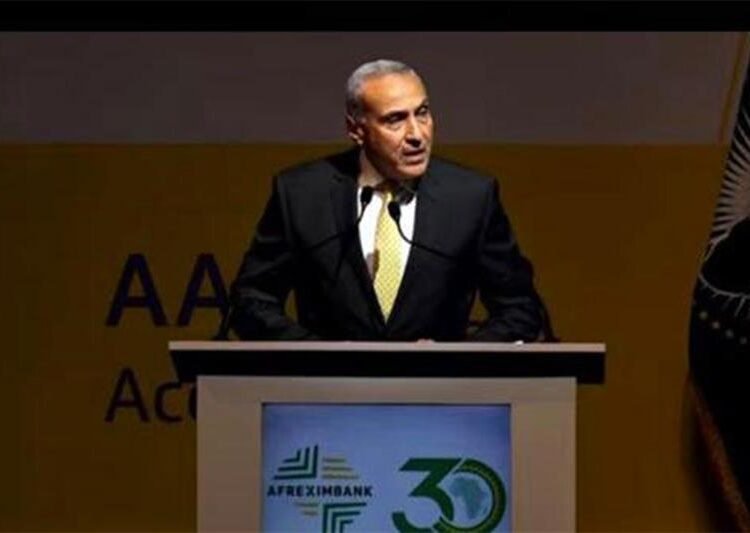

Egypt’s minister of finance and chairman of the Afreximbank, Mohamed Maait has encouraged Africans to collaborate towards finding integrated solutions to the new challenges confronting the continent at the 30th Annual General Meetings of the African Export-Import Bank (Afreximbank) in Accra.

The statement was declared on behalf Mohamed Maait by Deputy Governor of Central Bank of Egypt, Gamal Negm.

Maait lauded Afreximbank for playing a significant role in developing and implementing solutions to address the challenges confronting Africa and expressed the hope that AAM2023 would lead to even more constructive solutions to Africa’s problems, describing the bank as one of the African institutions delivering on the African Union’s (AU) Vision 2063.

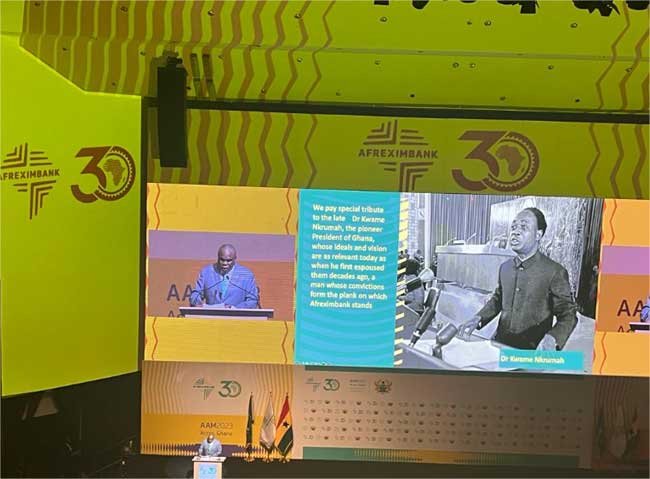

“Thanks to the vision of African leaders who founded Afreximbank 30 years ago, one by one, they are being delivered within the framework of “Team Africa”, comprising the African Union and its Agencies, AfCFTA Secretariat and Afreximbank as the underpinning banker. So today, the Pan-African Payment and Settlement System (PAPSS) is up and running, which will save the continent 5 billion US dollars in intra-African transfer changes. It will also expedite and enable payments for intra-African trade in African currencies,” President and Chairman of the Board of Directors Prof. Benedict Oramah said in his inaugural speech.

“Afreximbank has also brought a new kind of hope to Africa: the capacity to confront global challenges without going abegging. The COVID-19 pandemic and Ukraine crisis exposed the vulnerability of Africa in many ways. From the break of the pandemic in 2020 to the Ukraine crisis in 2022, the Bank has disbursed over 45 billion US dollars into the continent, which enabled many governments, central and commercial banks, corporates, and SMEs to weather the combined effects of these crises by helping countries to honour maturing trade debt payment obligations; to pay for critical imports and to pursue strategic investments. In the past 30 years, the bank has disbursed over 100 billion US dollars.

“It took the Bank 30 years to reach 30 billion in total assets and guarantee; I look ahead with confidence and declare that the Bank will double its size to 60 billion in less than 6 years,” he concluded.

Earlier, Ernest Yedu Addison, governor of the Bank of Ghana, delivering his welcome remarks, said that Ghana represented the most appropriate venue for the celebration of Afreximbank’s 30th anniversary, given the bank’s role in developing and promoting African trade and the fact that Ghana was the home of the African Continental Free Trade Area (AfCFTA) Secretariat.

Addison said that Afreximbank has been very supportive of Ghana and has, over the years, provided more than $2 billion to support the Ghanaian economy.

He commended Afreximbank for the approach it adopted in its work which emphasised a collaborative approach in dealing with other continental institutions.

Wamkele Mene, secretary-general of the AfCFTA Secretariat, said that with the inclusion of a vision for an integrated African market in the founding treaty of the Organisation of African Unity, the founding fathers of the AU had foreseen the need for Afreximbank.

Afreximbank had also launched PAPSS to allow for intra-African trade payments to be done in local currencies, he noted. It also introduced the Intra-African Trade Fair (IATF), a platform for exchange that Africa needed to meet the needs of the AfCFTA.

The meetings also featured panel sessions on turbo-charging implementation of the AfCFTA; building prosperity for Africans: the challenges of peace and security; overcoming the challenges of food security for sustainable development in Africa; as well as a conversation with Aliko Dangote, group president and chief executive of Dangote Group.

Afreximbank Annual Meetings (AAM2023), which end on 21 June, are also being held to celebrate the 30th anniversary of the establishment of Afreximbank.