The Bank of Industry has announced that it has accessed a €100m line of credit under the Transforming Financial Systems for Climate (TFSC) programme of the agency, in collaboration with the Green Climate Fund (GCF).

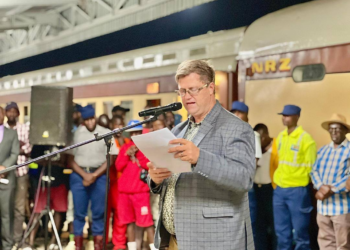

The Managing Director, BOI, Olukayode Pitan said this at the 2nd Regional Roundtable on Creating World Class Sustainable Development Financial Institutions through embracing holistic sustainability.

The event, organised by the Africa Association of Development Finance Institutions was attended by the Chairman of AADFI Mr. Thambo Thamane; the Secretary General of AADFI, Cyril Okoye; and Patricia Ojangole of the Ugandan Development Bank, and Chairman of the International Council of Sustainability Standards and CEO, European Organisation for Sustainable Development (EOSD) Mr. Arshad Rab, among other top officials.

Pitan, who is also the Chairman of the Association of Nigerian Development Finance Institutions said the €100m line of credit would be channelled towards financing investments that contribute to mitigation and adaptation measures to climate change, toward promoting low-emission transition in Nigeria.

In addition, he said that that the Bank of Industry also has access to the $600m Global Environment Fund (GEF)/ Resource Efficiency and Cleaner Production (RECP) credit guarantee scheme that would support it in financing the procurement of plant and machinery for projects that would promote industrial energy efficiency.

He said since the Sustainable Development Goals were launched, there have been concerted efforts globally, to ensure that ‘sustainability’ is advertised and sold to the world not for profit, but to ensure that sustainability is achieved with active and unwavering commitment from all stakeholders in the global ecosystem.

Pitan stated that one of the primary drivers of the developmental strategy at the Bank of Industry is to accelerate the industrialization of the Nigerian economy by providing financial and business support services to environmentally-friendly and sustainable projects across key sectors of the economy.

In the light of this, the BOI MD said the bank set up a full-fledged Environmental & Social Governance team in 2019, which manages its sustainability strategy and activities.

He recalled that in 2013 the Bank set up a group that supports renewable energy projects, noting that through this structure, it went into partnership with UNIDO, funded and commissioned six mini-grid power solutions to provide solar energy to six rural communities across the six geo-political zones.

He explained that for over eight years since the projects were commissioned, the benefitting communities have been enjoying 24-hour uninterrupted green power supply.

He told the gathering that the Bank has also integrated the Environmental and Social Management System (ESMS) framework into its end-to-end credit appraisal, approval, disbursement and credit monitoring activities.

The BOI boss also said that the bank last year commenced the registration processes toward obtaining the Sustainability Standards and Certification Initiative (SSCI) accreditation.