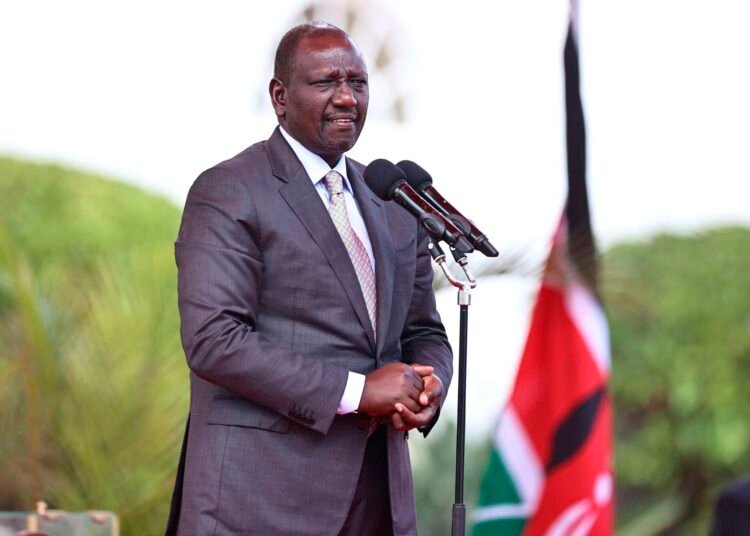

Kenyan President William Ruto is confident of a positive response from the International Monetary Fund (IMF) for a $1 Billion disbursement citing an improving Kenyan economy which averted a major debt crisis earlier in the Year.

According to the East African, Kenyan local currency resurged from record lows after the government issued a $1.5 billion Eurobond in February that calmed market uncertainty over an impending default on a $2 billion bond that matures in June.

Kenya’s local currency challenges combined with high inflation and new taxes have driven up the cost-of-living sparking anger and protest in the country.

The Kenyan government has been able to navigate a liquidity crisis due to robust lending from global financial institutions like the IMF and World Bank.

The Kenyan President said that IMF officials will arrive in the country next week to review the country’s eligibility for the expected $1 billion disbursement from the IMF.

He added that negotiations between the Kenyan Cabinet Secretary of Finance and the IMF in Washington during the World Bank IMF Spring Meeting earlier this month were incredibly successful.

However, recent floods in the country have left about 169 people dead and displaced many adding more pressure on government spending.

Earlier during the week, President Ruto and other African heads of state called on rich countries to contribute record amounts to a low-interest World Bank facility for developing Nations citing a rising debt profile and harsh climate change conditions.