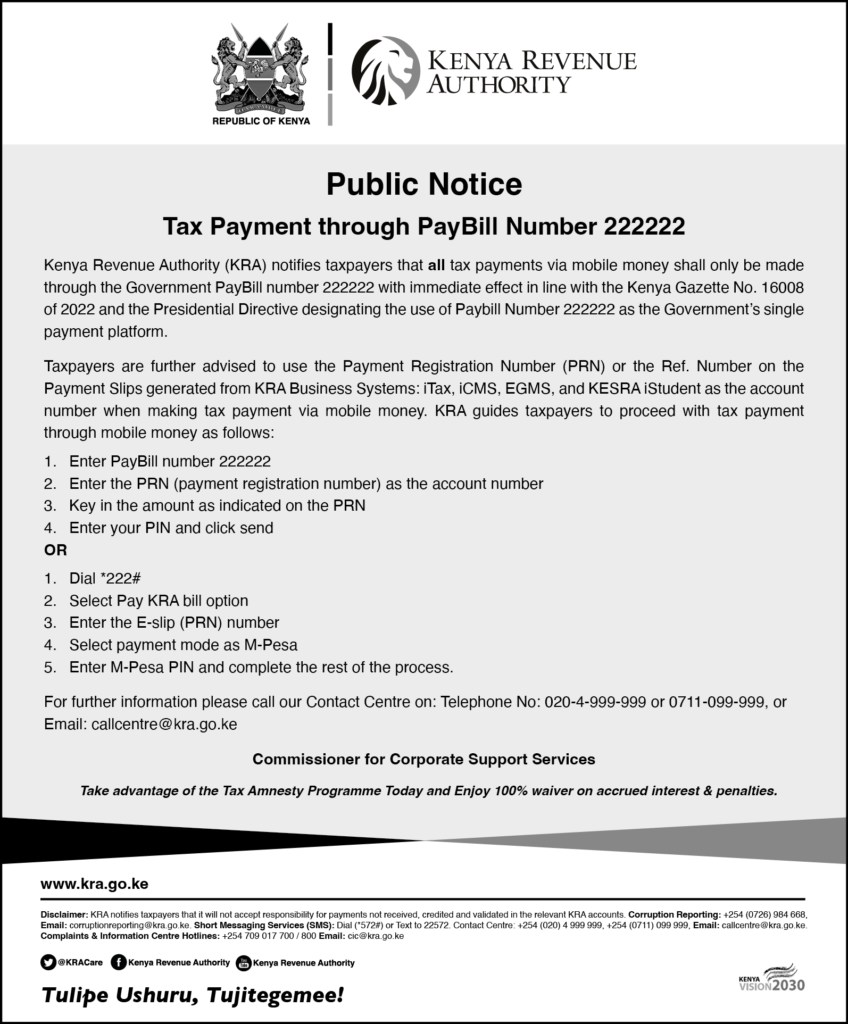

Kenya Revenue Authority (KRA) has issued a directive that all tax payments made through mobile money platforms must now be exclusively processed via the government PayBill number 222222.

This move aligns with the stipulations outlined in the Kenya Gazette No. 16008 of 2022 and follows a Presidential Directive designating PayBill number 222222 as the sole payment platform for government transactions.

Taxpayers are urged to utilize the Payment Registration Number (PRN) or the Reference Number on payment slips generated from KRA Business Systems, including iTax, EGMS, and KESRA iStudent, when making tax payments through mobile money channels.

The KRA provided clear guidelines for taxpayers to successfully complete their mobile tax payments, emphasizing the significance of adhering to this new procedure.

KRA has released a step-by-step guide for taxpayers to seamlessly make their tax payments through mobile money using the designated government PayBill number 222222. Taxpayers have two options to follow this procedure:

Option 1

- Enter PayBill number 222222.

- Input the Payment Registration Number (PRN) as the account number.

- Key in the amount indicated on the PRN.

- Enter your PIN and click send to complete the transaction.

OR

Option 2

- Dial *222# on your mobile device.

- Select the “Pay KRA Bill” option from the menu.

- Enter the E-slip (PRN) number provided.

- Choose payment mode as M-Pesa.

- Enter your M-Pesa PIN to finalize and complete the payment process.